All Categories

Featured

Table of Contents

At the end of the day you are buying an insurance coverage item. We enjoy the security that insurance coverage supplies, which can be obtained much less expensively from a low-cost term life insurance policy. Unpaid fundings from the policy may additionally lower your survivor benefit, lessening one more degree of security in the plan.

The concept only functions when you not only pay the significant costs, however utilize extra cash to purchase paid-up additions. The possibility expense of all of those dollars is remarkable exceptionally so when you might instead be buying a Roth IRA, HSA, or 401(k). Even when compared to a taxable financial investment account or perhaps an interest-bearing account, limitless financial may not offer comparable returns (compared to spending) and comparable liquidity, accessibility, and low/no fee structure (compared to a high-yield interest-bearing accounts).

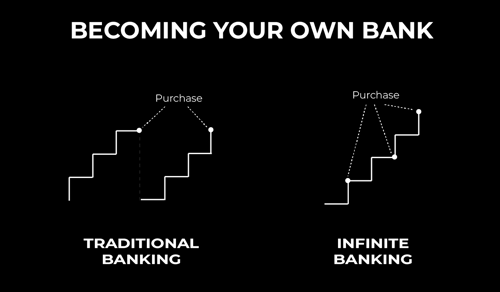

When it concerns monetary planning, whole life insurance often attracts attention as a prominent alternative. Nevertheless, there's been an expanding trend of advertising it as a tool for "unlimited financial." If you have actually been discovering whole life insurance policy or have actually come across this concept, you could have been told that it can be a method to "become your own bank." While the idea may seem appealing, it's critical to dig deeper to comprehend what this truly implies and why watching whole life insurance coverage this way can be deceptive.

The idea of "being your very own bank" is appealing because it recommends a high level of control over your financial resources. Nonetheless, this control can be illusory. Insurer have the supreme say in just how your plan is handled, including the terms of the lendings and the prices of return on your cash worth.

If you're thinking about entire life insurance policy, it's vital to view it in a wider context. Whole life insurance policy can be a useful tool for estate preparation, providing a guaranteed fatality benefit to your beneficiaries and potentially providing tax advantages. It can also be a forced savings car for those who have a hard time to save cash continually.

It's a type of insurance coverage with a cost savings element. While it can offer consistent, low-risk development of cash value, the returns are normally lower than what you may attain with other investment cars (infinite banking scam). Before leaping right into whole life insurance coverage with the idea of infinite banking in mind, make the effort to consider your financial goals, risk resistance, and the full variety of financial items available to you

Infinite Banking Examples

Infinite financial is not an economic panacea. While it can function in particular circumstances, it's not without risks, and it requires a significant dedication and understanding to take care of efficiently. By acknowledging the potential challenges and understanding truth nature of whole life insurance policy, you'll be better outfitted to make an educated choice that supports your financial health.

This book will instruct you exactly how to establish up a financial policy and just how to make use of the banking plan to spend in realty.

Infinite financial is not a services or product offered by a specific institution. Infinite financial is a strategy in which you acquire a life insurance policy policy that builds up interest-earning cash money value and take out lendings against it, "borrowing from on your own" as a resource of resources. At some point pay back the finance and begin the cycle all over again.

Pay policy costs, a section of which constructs cash worth. Money value earns intensifying passion. Take a financing out versus the plan's money worth, tax-free. Repay car loans with passion. Cash money value gathers once more, and the cycle repeats. If you use this concept as meant, you're taking money out of your life insurance policy policy to acquire every little thing you 'd need for the remainder of your life.

The are whole life insurance coverage and universal life insurance policy. The cash worth is not added to the death benefit.

The policy lending interest rate is 6%. Going this route, the passion he pays goes back into his plan's cash money worth instead of a financial organization.

Infinite Banking Concept Explained

Nash was a money specialist and fan of the Austrian college of business economics, which advocates that the value of goods aren't explicitly the outcome of standard financial frameworks like supply and demand. Rather, individuals value money and goods in different ways based on their economic condition and needs.

One of the risks of standard financial, according to Nash, was high-interest rates on car loans. Long as financial institutions set the rate of interest prices and funding terms, people didn't have control over their own wide range.

Infinite Financial requires you to own your monetary future. For ambitious individuals, it can be the ideal financial tool ever before. Here are the benefits of Infinite Financial: Probably the solitary most useful facet of Infinite Banking is that it boosts your cash circulation.

Dividend-paying whole life insurance coverage is really reduced threat and provides you, the insurance holder, a great offer of control. The control that Infinite Banking provides can best be organized right into 2 classifications: tax advantages and asset protections.

When you utilize entire life insurance coverage for Infinite Banking, you get in into an exclusive agreement between you and your insurance policy business. These defenses might vary from state to state, they can include security from possession searches and seizures, defense from reasonings and protection from creditors.

Entire life insurance coverage plans are non-correlated assets. This is why they function so well as the financial foundation of Infinite Banking. Regardless of what takes place in the market (supply, actual estate, or otherwise), your insurance plan retains its worth.

Royal Bank Visa Infinite Avion

Entire life insurance is that third container. Not only is the rate of return on your entire life insurance policy ensured, your fatality benefit and premiums are additionally ensured.

This structure lines up perfectly with the principles of the Perpetual Riches Method. Infinite Financial appeals to those seeking better financial control. Here are its main advantages: Liquidity and availability: Plan finances provide immediate accessibility to funds without the limitations of conventional small business loan. Tax obligation performance: The money value grows tax-deferred, and policy financings are tax-free, making it a tax-efficient tool for constructing riches.

Asset protection: In several states, the cash value of life insurance policy is protected from lenders, adding an extra layer of financial protection. While Infinite Banking has its values, it isn't a one-size-fits-all remedy, and it includes substantial downsides. Below's why it might not be the ideal approach: Infinite Financial often requires elaborate plan structuring, which can puzzle insurance policy holders.

Imagine never having to stress regarding bank loans or high interest rates again. That's the power of boundless banking life insurance coverage.

There's no collection lending term, and you have the flexibility to make a decision on the repayment timetable, which can be as leisurely as paying back the loan at the time of fatality. This versatility extends to the maintenance of the financings, where you can choose for interest-only payments, maintaining the funding equilibrium flat and manageable.

Holding cash in an IUL dealt with account being credited rate of interest can frequently be much better than holding the cash money on deposit at a bank.: You have actually always dreamed of opening your own bakeshop. You can obtain from your IUL plan to cover the initial expenditures of renting out a room, buying devices, and working with staff.

Infinite Banking Book

Individual finances can be gotten from conventional financial institutions and credit history unions. Borrowing cash on a credit card is usually extremely expensive with yearly percent rates of interest (APR) frequently reaching 20% to 30% or more a year.

The tax obligation treatment of policy loans can vary considerably relying on your country of home and the specific terms of your IUL policy. In some areas, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, policy loans are normally tax-free, supplying a significant advantage. Nonetheless, in other territories, there may be tax obligation implications to take into consideration, such as prospective taxes on the car loan.

Term life insurance just provides a death advantage, without any cash money worth buildup. This suggests there's no cash value to borrow versus.

However, for finance officers, the substantial regulations imposed by the CFPB can be seen as difficult and limiting. First, finance policemans often suggest that the CFPB's guidelines create unnecessary red tape, resulting in more documentation and slower lending processing. Policies like the TILA-RESPA Integrated Disclosure (TRID) rule and the Ability-to-Repay (ATR) demands, while focused on securing customers, can bring about hold-ups in shutting deals and enhanced operational prices.

Latest Posts

Nelson Nash Life Insurance

Wealth Nation Infinite Banking

Infinite Banking Definition